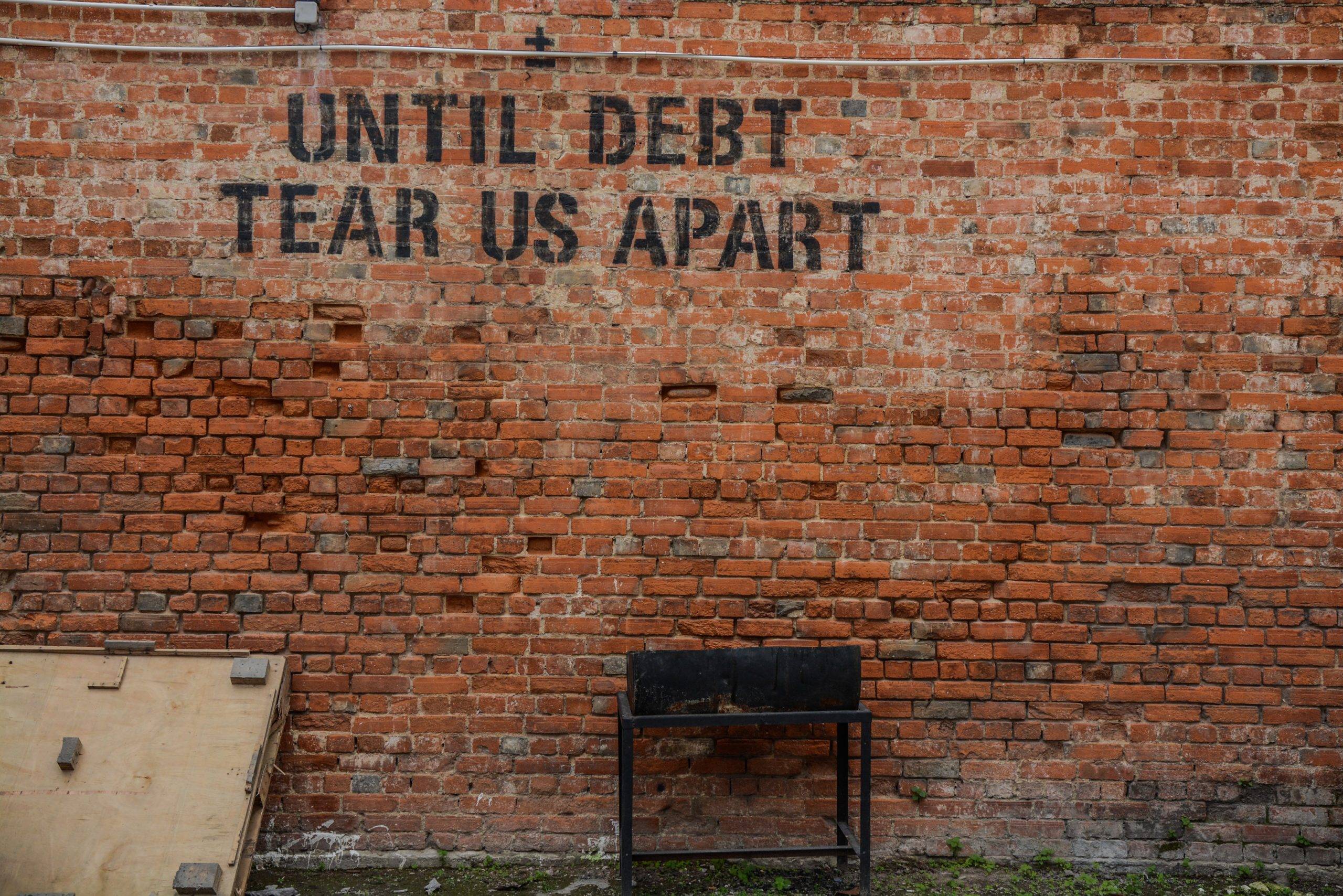

Running a business can be exciting and fulfilling, but it also comes with its own set of financial challenges. One of the biggest challenges that entrepreneurs face is managing debt. Whether it’s from loans, investments, or other sources, debt can quickly spiral out of control and leave you feeling overwhelmed. But don’t worry; you’re not alone!

In this blog post, I’m going to share some practical tips and strategies for conquering debt as a business owner and achieving financial stability. By the end of this post, you’ll have a clear understanding of how to manage your debt effectively and keep your business on track. So, let’s get started!

1. Create a debt repayment plan

The first step in managing your debt is to create a debt repayment plan. Start by making a list of all your debts and their interest rates. Then, prioritize your debts based on the interest rate, with the debt with the highest interest rate being the first one to pay off. This will help you save money in the long run and get out of debt faster.

2. Live within your means

One of the biggest mistakes that entrepreneurs make is overspending. In order to manage your debt, it’s important to live within your means and avoid taking on more debt than you can handle. This means being mindful of your spending and avoiding unnecessary expenses.

3. Consider consolidating your debt

Consolidating your debt can help simplify your debt repayment plan and reduce the amount of interest you pay over time. By consolidating your debt into one loan with a lower interest rate, you can simplify your payments and reduce the amount of interest you pay over time.

4. Make extra payments whenever possible

Making extra payments on your debts can help you get out of debt faster and save money in the long run. Consider making a plan to make extra payments whenever possible, such as cutting back on discretionary spending or taking on a side job.

5. Seek professional help

If you’re feeling overwhelmed by debt, consider seeking the help of a professional financial advisor. A financial advisor can help you create a debt repayment plan, provide guidance on managing your finances, and connect you with resources that can help you achieve your financial goals.

By following these tips, you can take control of your debt and achieve financial stability as a business owner. It may take time and effort, but the peace of mind and financial stability that comes with conquering debt are worth it. Remember, you’re not alone. There are resources available to help you manage your debt effectively and achieve your financial goals.

Managing debt as an entrepreneur can be a challenging task, but it is possible to achieve financial stability with the right strategies in place. By living within your means, consolidating your debt, making extra payments, and seeking professional help, you can take control of your debt and focus on growing your business. So, don’t be discouraged by debt. Embrace it as a challenge and use it as an opportunity to learn and grow as a business owner.