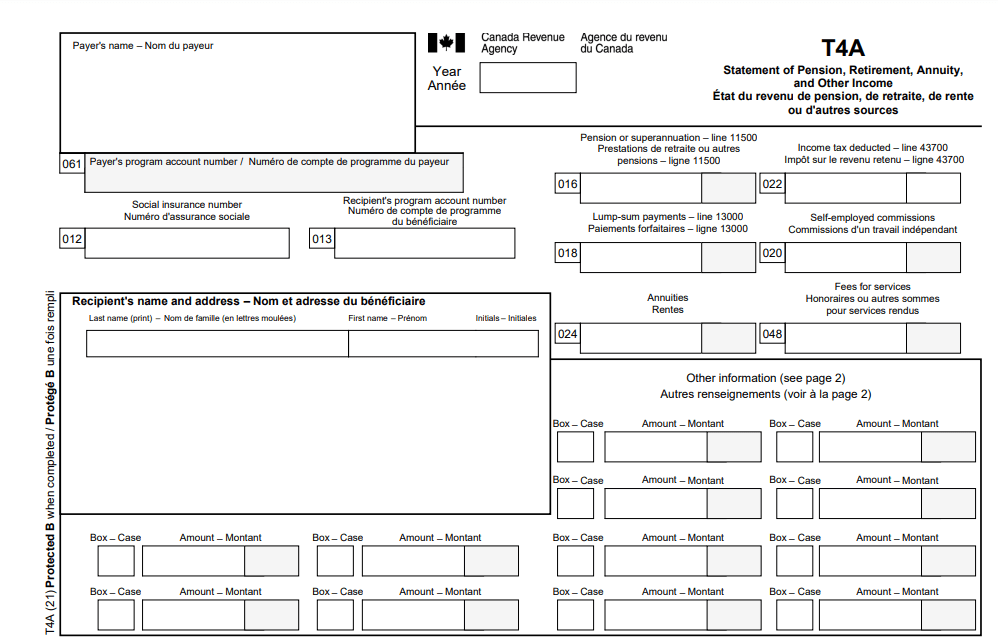

T4A slips are used to report different types of income. Chances are you might have received a T4A if you worked as an independent contractor. You will also receive a T4A slip if you have income from retiring allowance, pensions, annuities, or other types of income. These other types of income include:

- patronage allocations

- registered education savings plan (RESP) accumulated income payments

- RESP educational assistance payments

- fees or other amounts for services

- Income replacement payments made under the Veterans Well-being Act

- Self-employed commissions

However, what if you aren’t on the receiving end? What if you are a payer who needs to file a T4A slip? How do you fill out the T4A and transmit it to CRA?

One of the most common reasons that a business owner needs to prepare a T4A is to report subcontractor payments. Not all small business owners have the resources to employee a full time marketing specialist or an accountant and would typically outsource these functions!

Whether you are a sole proprietor or a corporation, you are responsible for completing and filing T4As for services paid to subcontractors. CRA has clear guidelines on preparing and filing T4As with a deadline of the last day of February. If the last day of February falls on a Saturday or Sunday, your return is due the next business day.

Book a consultation today to get the help you need to prepare and file your T4As on time!