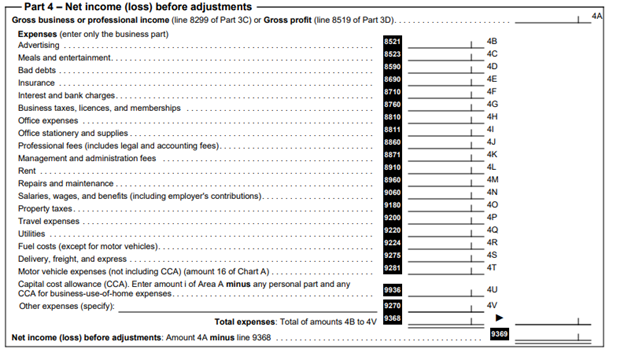

T2125 or the Statement of Business or Professional Activities, is the form that sole proprietors use to report the income their business earned in the previous tax year. The T2125 is completed as part of the personal income tax return.

Below is a list of the most common expenses that can be claimed. Generally, any reasonable expense that you incur for the purpose of earning business income is deductible.

Home Office Expenses

You can deduct a portion of the below expenses as per the percentage that your home office space is to the size of your home.

- Utilties – gas, hydro, phone

- Mortgage interest or rent

- Repairs

- Property taxes if applicable

- Insurance

Vehicle Expenses

You can deduct expenses related to your car if you use it for business purposes. You need to keep a log to record the business mileage. Only the percentage for business use is deductible. These include:

- Repair and maintenance

- Gas

- Toll charges

- Parking

- Insurance

- Tax depreciation (if you own it) or lease payments (if leased) which ever is applicable.

Supplies and Tools

Supplies and tools purchased for your business are tax deductible. Examples include, stationary, business phone, hammer, etc.

Computer Software

You can claim capital cost allowance or CCA in short on computer and software purchases.

For computers, you can deduct 55% per year and 50% per year for software

Travel

You can deduct travel expenses that are incurred for the purpose business earning income. Examples include airfare and hotel accommodations to attend business meeting or seminar can be deducted.

Meals and Entertainment

Only 50% of meals and entertainment costs can be deducted provided that they are incurred for business purposes, such as meeting with clients or suppliers.

CRA has detailed guidelines on reporting your business income on form T2125.

Book a consultation today to get the help you need to prepare and file your income tax return on time!